Top Prop Trading Mistakes and How to Avoid Them

- Ankit Gupta

- September 3, 2025

Introduction

Mistakes in trading are bound to happen, as not every trade you place would go as planned, because markets are volatile and unpredictable. However, with the right planning, you can minimize the number of mistakes you make and limit your losses.

In this blog, we will look at common mistakes some prop traders encounter and how to avoid them.

Why Mistakes in Prop Trading Can Be Costly

Mistakes are a natural part of any learning process, but in prop trading, they can be especially costly. Unlike personal trading, here you have to follow the firm’s rules. Breaking them may mean failing your challenge or even termination of your funded account. On top of that, consistent mistakes take down your performance, making it harder to grow and secure payouts.

The good thing is, once you know where traders usually go wrong, you can prepare yourself and stay clear of those traps.

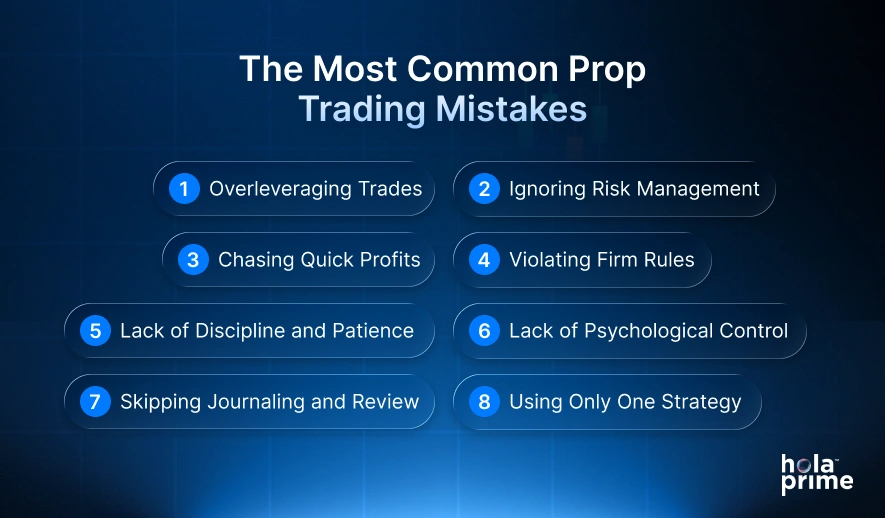

The Most Common Prop Trading Mistakes Traders Make

Let’s break down some of the most frequent mistakes traders commit when trading with a prop firm:

1. Overleveraging Trades

Many traders get carried away when they suddenly have access to bigger capital. They start taking oversized positions, thinking bigger trades mean bigger profits. The problem is, larger positions also mean larger losses. A single bad trade can wipe out days of progress.

How to avoid it: Keep your position sizes within safe limits. Follow the 1 – 2% rule, where you don’t risk more than a small percentage of your account per trade.

2. Ignoring Risk Management

Skipping stop-loss orders or risking too much on one trade is another mistake. Risk management may sound boring, but without it, your account won’t survive for long.

How to avoid it: Always place a stop-loss, know your maximum drawdown, and stick to firm rules. Risk management should be the foundation of every trade, not an afterthought.

3. Chasing Quick Profits

Many traders think prop trading is about hitting home runs every day. They try to double their account quickly and often overtrade in the process. Unfortunately, this approach usually ends with broken rules and failed evaluations.

How to avoid it: Focus on consistency. Prop firms are more interested in steady results than sudden profits. Aim for small but reliable gains over time.

4. Violating Firm Rules

Proprietary firms have rules that explain to traders what they can and cannot do, including daily loss limits, maximum drawdowns, max lot size, etc. Even though this information is usually available to traders, many traders do not follow or even bother to learn what their firm’s rules are. Even if you are a consistently profitable trader, if you break a firm’s rule, you will still have your account revoked.

How to avoid it: Read the rules before you start trading, and as a Turbo tip, if necessary, write down the firm’s rules and keep them near you while trading.

5. Lack of Discipline and Patience

Trading out of boredom or jumping into a trade without a setup are classic mistakes. Some traders also fall into “revenge trading” where they try to recover losses quickly. These actions rarely end well.

How to avoid it: Stick to your trading plan and wait for proper setups. Remember that sometimes the best trade is no trade at all.

6. Lack of Psychological Control

Fear, greed, and overconfidence are important aspects in making trading decisions and a single emotional trade can cost you money and your funded account.

How to avoid it: Create trading discipline. If trading under stress, step away from the computer. Meditation, journaling, or a walk can help relieve tension in your mind.

7. Skipping Journaling and Review

One of the biggest mistakes is not keeping track of your trades. Without a trading journal, you won’t know what’s working and what isn’t. You’ll likely repeat the same errors without realizing it.

How to avoid it: Maintain a trading journal where you note down the reason for your trade, the outcome, and what you learned. Over time, this will become your most valuable teacher.

8. Using Only One Strategy

Markets do not always stay the same. What works now might not work tomorrow. Some traders are too slow to adapt and end up stuck when market conditions change.

How to stop it: Always be learning and adapting. Test new strategies in demo accounts and start to build a toolbox of strategies that you can apply in different scenarios.

Conclusion :

In trading, not all your trades will go as you plan and there will always be moments of learning. During such times, it is important to stay calm and composed and take note of what worked well and what did not. For instance, if you overtrade to cover up some losses, you can mention it in your trading journal and avoid that in the future. If you are looking to take your trading to the next level, you should check out Hola Prime’s Discord channel, where you can chat directly with the top trading coaches and even book a free 1-on-1 coaching session where you can discuss your precise doubts and get solutions.

FAQs :

1. Is it possible for beginners to succeed in prop trading?

Yes, but they need to invest time in learning and approach risk management and profit chasing sensibly.

2. What is the biggest danger in prop trading?

The biggest dangers are usually overleveraging and ignoring firm rules.

3. Do I need multiple strategies to be successful?

Obviously, market conditions can change, so it is smart to have more than one strategy. You will also want to be flexible in your approach to be able to adapt when circumstances change.

4. How do I know if I’m ready for a prop firm challenge?

If you have a trading plan, follow risk management, and can stay disciplined under pressure, you’re ready to try.

5. Should I practice on a demo account before joining a prop firm?

Yes, it is always a good idea to trade on a demo account so that you can get an idea about how the market moves and its volatility. Moreover, it will help you get familiar with the trading tools offered by the prop firm.

Disclaimer: All information provided on this site is for educational purposes only, related to trading in financial markets. It is not intended as financial advice, business or investment recommendation, or as an opportunity or recommendation to trade any investment instruments. Hola Prime only provides an educational environment to traders, including tools, materials and simulated trading platforms which have data feed provided by Liquidity Providers. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations.