Futures Prop Trading Rules Explained: Drawdowns, Scaling & Max Loss

- Ankit Gupta

- August 27, 2025

1. Introduction to Futures Prop Trading

Futures prop trading is one of the most exciting and high-stakes ways to engage in financial markets. Unlike retail trading, where you’re limited to your own capital, prop trading gives you access to firm capital, enabling you to trade larger positions with less personal risk. However, with this access comes responsibility, especially when it comes to futures trading rules.

In this article, we’re going to break down everything you need to know about how futures prop firms structure their rules, why those rules matter, and how they impact your daily trading. From understanding what drawdown means to the nuances of scaling models, we’ll cover it all, especially focusing on popular instruments like the ES and 6E futures.

If you’ve ever wondered why prop firms limit you from holding trades overnight or how they calculate your max loss, this comprehensive guide will provide all the answers and help you become a more disciplined, profitable trader in the process.

2. What are Futures?

Futures are standardized financial contracts that obligate the buyer to purchase, or the seller to sell, an asset at a predetermined future date and price. These contracts are traded on exchanges, and when you trade these contracts, you are not buying or selling anythin;g you are just predicting the price movement to earn profits.

The beauty of futures lies in their leverage, liquidity, and the ability to profit in both rising and falling markets. Traders speculate on the future price of commodities, indices, or currencies, often without ever owning the actual asset.

In prop trading environments, futures instruments like the S&P 500 E-mini (ES) or Euro FX (6E) are frequently used because of their tight spreads, high volume, and excellent volatility.

3. What is Prop Trading?

Proprietary (or “prop”) trading is when traders use a firm’s capital to place trades, rather than their own money. In return, the firm takes a share of the profits and sometimes absorbs losses. The firm’s goal is to profit from your trading skill, and your goal is to pass an evaluation so you can access more capital.

Most prop firms have a two-step evaluation process – typically involving a simulated account where you must follow strict futures trading rules to prove you can manage risk effectively.

These rules form the backbone of prop trading and are designed not only to protect the firm but also to build structure around your trading process.

4. Why Futures Are Popular in Prop Trading

There are several reasons why futures dominate the prop trading landscape:

- Liquidity: Instruments like ES and 6E are heavily traded.

- Transparency: Centralized exchanges reduce counterparty risk.

- Regulation: Futures markets are well-regulated compared to OTC products.

Because of this, prop firms prefer futures, and they build tailored trading rules around them to ensure traders can participate without exposing the firm to unnecessary risk.

5. Overview of Futures Trading Rules

Futures trading rules in a prop firm serve as a framework. These include:

- Maximum daily drawdown limits

- Total account max loss limits

- Profit targets

- Time-based trading restrictions

- Instrument restrictions

- Trade frequency or contract restrictions

The goal? Ensuring that traders don’t take excessive risk and that successful traders can grow with consistency and control.

These rules are especially important when trading volatile assets like ES or 6E, where a single mistake can cost thousands.

6. Understanding the Role of Rules in Prop Firms

Have you ever wondered why prop firms seem so obsessed with rules? It’s not just about control – it’s about protection. Imagine giving someone $100,000 to trade. Wouldn’t you want some guardrails in place?

Prop firms aren’t being strict just for the sake of it. They’re offering you a rare opportunity: to trade with someone else’s money. And with that comes a responsibility to manage risk, think long-term, and act like a professional – even if you’re still new to the game.

Rules are like the bumpers in a bowling alley. They’re not there to limit your fun. They’re there to stop your game from ending in disaster.

7. Key Metrics: Drawdown, Max Loss,

Let’s break it down. If there’s one thing every prop trader needs to get comfortable with, it’s drawdown, max loss. These are the foundations of risk management in the prop trading world. Ignore them, and your journey ends before it even begins.

Drawdown tells the firm how deep your losses run when things go wrong. Max loss? That’s your stop sign, the boundary you can’t cross.

But here’s the twist: these numbers aren’t just cold calculations. They’re psychological checkpoints, too. They force you to pause, think, and manage emotions. Isn’t that what separates a gambler from a disciplined trader?

8. What is Drawdown in Futures Prop Trading?

Let’s say you start with a $50,000 account. After a few solid trades, you’re up to $53,000. But then, a few impulsive decisions later, you’re down to $51,000. That’s a $2,000 drawdown from your peak.

In prop trading, especially with futures, drawdown is a key performance metric. It’s not just about how much you make, it’s about how much you lose along the way.

Think of it like a heartbeat monitor. If the dips get too deep, it signals something unhealthy in your trading. The firm sees that and steps in, not to punish you, but to protect both sides.

And let’s be honest: wouldn’t you rather catch bad habits early than after your entire capital is wiped out?

9. Types of Drawdown: Daily vs Overall

There are two kinds of drawdowns you’ll need to master: daily drawdown and overall drawdown. Sounds technical? It’s really not.

Daily drawdown is the maximum you can lose in a single trading day. Hit that limit? Your account might be paused or even disqualified.

Overall drawdown, on the other hand, is like your total leash. It’s how much you can lose from the highest point your account balance has reached.

Imagine them as two different types of brakes on a car: the daily limit is your handbrake, instant control. The overall limit? That’s your seatbelt, keeping you safe on longer journeys.

10. Examples of Drawdown Calculations

Let’s bring it to life with some numbers.

Suppose your prop firm gives you a $100,000 evaluation account. You’re allowed a maximum overall drawdown of $3,000, and a daily drawdown limit of $1,500.

- On Monday, you lose $1,000. You’re fine.

- On Tuesday, you lose $1,600. Uh-oh – daily drawdown breached.

- Even if your total drawdown is only $2,600, that daily violation could cost you the account.

Seems harsh? Not really. These rules are meant to weed out reckless behavior. Because if you can’t respect limits now, what happens when you’re managing six figures?

11. Why Drawdown Rules Exist in Prop Firms

So why are firms so insistent on these drawdown rules? Is it just risk control?

Yes, and more. These limits also test your ability to recover. Can you come back from a red day without chasing losses? Can you accept when it’s time to step away?

These are the hidden questions that firms are asking through their rules. And traders who pass this silent test? They’re the ones who get funded and stay funded.

12. Psychological Impact of Drawdown Limits

Drawdown limits don’t just affect your numbers; they affect your mind. They can either help you build emotional discipline or spiral you into panic, depending on how you view them.

Some traders see them as constraints. Others see them as boundaries that offer freedom- the freedom to trade boldly, without falling off a cliff.

Which trader are you?

13. What is Max Loss in Futures Prop Trading?

Now let’s talk about the big one: Max Loss. It’s the line you never want to cross.

Max loss is the total amount you’re allowed to lose before your evaluation or funded account is closed. It’s the final safety net, the firm’s way of saying: “This far, and no further.”

But don’t think of it as punishment. Think of it as a professional boundary. If you had employees trading your capital, wouldn’t you want a similar rule?

14. Fixed vs Trailing Max Loss Explained

Here’s a subtle, but crucial distinction: fixed vs trailing max loss.

- Fixed Max Loss: You’re allowed to lose a set amount from your starting balance, no matter how much you gain.

- Trailing Max Loss: The allowed loss moves up as your account grows, protecting the profits you’ve made.

At first glance, trailing max loss seems stricter, but it teaches you to protect your gains. Isn’t that what every trader ultimately wants?

15. How Prop Firms Monitor Max Loss

Ever feel like someone’s watching your every trade? In prop trading, they kind of are, but not in a creepy way.

Most modern prop firms use automated systems to monitor your account in real-time. The moment you breach your max loss, whether it’s daily or overall, the system flags it. Sometimes it even auto-closes your account or locks you out until support reviews it.

But here’s the upside: there’s no gray area. No confusion. No delay. You know the rules going in, and you’re held to them. Isn’t that better than waking up to a nasty surprise?

16. Common Max Loss Triggers in Trading

Now, let’s talk about what causes most traders to hit that dreaded max loss.

- Revenge trading after a red day

- Overleveraging to try and fast-track gains

- Ignoring stop losses

- Trading during high-impact news events

- Being in too many positions at once

Sound familiar? The truth is, these are things most of us have done at some point. The goal isn’t to be perfect. It’s to be aware, so you can catch yourself before things spiral.

Remember: trading is 80% mindset, 20% mechanics. And max loss rules are there to help you win that mental game.

17. Scaling Rules: How Traders Get More Capital

Alright, here comes the fun part: scaling.

Scaling is the prop firm’s way of saying, “We trust you. Here’s more firepower.” Trade well within the rules, and you get more capital to play with.

But don’t expect it overnight. Most firms require consistency, not one lucky trade. You might need to hit specific profit milestones, maintain low drawdowns, or complete a minimum number of days before scaling up.

And honestly, wouldn’t you rather grow sustainably than burn out trying to get rich quickly?

18. Milestone-Based Scaling in Prop Firms

Every firm has its own flavor of scaling.

Some have rigid milestones – say, grow the account by 10% without breaching drawdown, and you get bumped up. Others review performance monthly and scale based on a combination of profit and discipline.

Either way, scaling is earned, not given. It’s not just about making money – it’s about proving you can protect it.

Because in trading, keeping your capital is just as important as growing it. Maybe even more.

19. Risk-Based Scaling Models

Some firms go a step further and offer risk-based scaling. What does that mean?

Instead of giving you more buying power outright, they increase your allowed risk per trade or your maximum drawdown buffer. It’s like loosening the leash gradually, based on your performance.

This is perfect for traders who prefer a slow, steady ramp-up instead of big leaps. And let’s be real – how many of us have blown up accounts by scaling too fast?

Sometimes, slow is smooth and smooth is fast.

20. Evaluation Accounts vs Simulated Funded Accounts Rules

A common misconception is that the rules stay the same once you pass your evaluation. Not always.

Some firms are stricter during evaluations, like enforcing minimum trading days or limiting profit targets. Once funded, they relax those rules but tighten others, such as payout schedules or maximum lot sizes.

It’s a bit like graduating from training wheels to a full bike. You still have to steer, but now the expectations are higher. You’ve proven yourself; now it’s time to show you can maintain it.

21. Futures Day Trading Rules Explained

Let’s shift gears and talk specifically about day trading rules in futures.

Day trading futures is fast, exciting, and often nerve-wracking. Most firms set rules around:

- Maximum positions open at once

- Trade duration (some don’t allow holding for more than a few hours)

- Time cut-offs (e.g., no new trades after 4:00 PM EST)

- Flat at close requirements (you must close all trades before market close)

Why so many limitations? Because futures markets move fast. And unchecked risk in a volatile environment? That’s a recipe for disaster.

But if you’re a disciplined day trader, these rules become your edge.

22. Key Differences Between Day Trading and Swing Trading Rules

Do you prefer letting trades run for days? Then you’ll want to know the biggest difference between day and swing trading rules.

Swing trading usually requires more capital and looser drawdown limits, but not every prop firm allows it. In fact, many firms prohibit overnight holding, especially for futures, due to unpredictable price gaps.

Day trading, on the other hand, fits neatly into risk models. It’s easier to monitor, contains daily exposure, and aligns with most firm structures.

So if you’re thinking of swing trading ES or 6E futures, check the rulebook. Not every firm will support that style.

23. Futures Trading Rules for the ES Futures

Now, let’s dive into the ES (S&P 500 E-mini), one of the most popular instruments in the world.

Why do traders love the ES?

- Tight spreads

- Massive liquidity

- Consistent volatility

- Deep institutional participation

But with great power comes… yep, you guessed it – more rules.

Prop firms often limit position sizes on ES, enforce tighter stop losses, and discourage trading during high-volatility news events. Why? Because the ES can move 10 points in minutes. And if you’re over-leveraged, that’s game over.

Trade the ES with respect, and it will reward you. Trade it recklessly? Not so much.

24. Why ES Futures (S&P 500 E-mini) Are Widely Traded

ES contracts are fast, powerful, and not for beginners.

It’s based on the S&P 500 index, meaning it reflects the performance of the top 500 US companies. When you trade the ES, you’re essentially betting on the broader US market.

That’s why it’s a favorite in prop firms. It’s predictable yet dynamic. It respects levels. And with enough screen time, you start to see the rhythm of it.

So why is it so heavily regulated in trading rules? Because one bad trade can ruin an account. But one great setup, traded with discipline? That’s your ticket to scaling up.

25. Trading Rules for the 6E Futures

So what about the 6E futures – the Euro FX Futures?

It tracks the EUR/USD currency pair but trades on the CME as a futures contract instead of a spot FX position.

In terms of rules, most prop firms treat 6E similarly to ES in some ways, with tight control on contract size, firm stop-loss requirements, and no holding during volatile macroeconomic events.

But here’s the catch: currency futures often behave differently. They move more slowly than indices but can react sharply to global news, especially interest rate decisions and central bank speeches.

So what does that mean for your trading?

You need to be precise, but patient. Prop firms love traders who understand that not every candle needs a trade.

26. Characteristics of 6E (Euro FX Futures)

Before you dive into the 6E, you need to know what makes it tick.

- It trades in 0.00005 increments, or “ticks,” each worth $6.25 per contract.

- Its daily range is generally more modest than ES, but it can still break out hard on news.

- It’s most active during the London and New York overlap, roughly 8 AM to 12 PM EST.

And here’s the thing, because it’s less volatile than ES, firms often allow tighter drawdown limits or expect slower account growth from 6E traders.

But don’t take that as a limitation. It’s a different game with different strengths. Want to build a calm, methodical trading plan? The 6E might be your best friend.

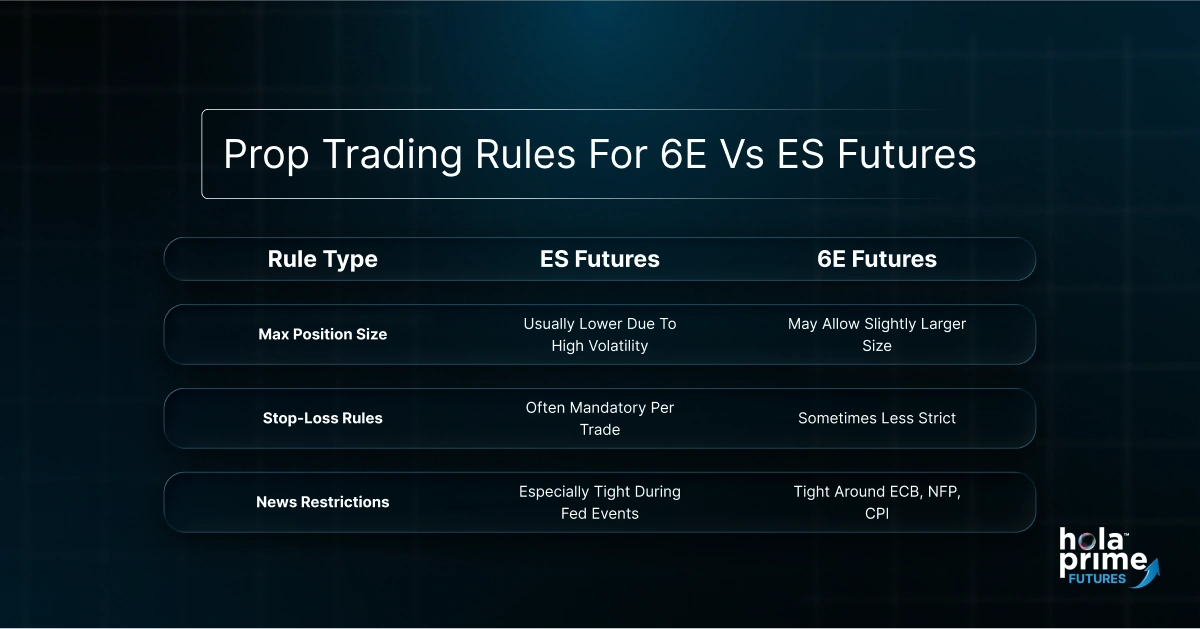

27. Prop Trading Rules for 6E vs ES Futures

Now you might ask: “Should I trade ES or 6E?”

Well… why not both?

But you should know that prop firms may apply different rules to each. For example:

This isn’t about which is better. It’s about which fits your temperament. Are you fast and aggressive? Try ES. More analytical and deliberate? Maybe 6E is your lane.

And of course, respecting the futures trading rules is non-negotiable for both.

28. Typical Evaluation Criteria by Futures Prop Firms

Every prop firm has its own flavor, but most evaluations boil down to a few key checkpoints:

- Profit Target (e.g., earn $6,000 on a $100K account)

- Max Daily Loss (e.g., $1,500)

- Max Total Loss (e.g., $3,000)

- Minimum Trading Days (e.g., 3 days)

- Consistency Rule (e.g., no single trade should make up 50% of profits)

- No Rule Violations (obviously!)

Sound intimidating? It’s not, if you plan for it. The traders who struggle are the ones chasing targets. The ones who pass? They let the targets come to them.

Isn’t that a better way to trade anyway?

29. Rule Differences Between One-Step and Two-Step Challenges

Now let’s talk challenge formats. Some firms have one-step evaluations -you meet the profit target and you’re funded. Others use two-step processes: a challenge phase 1 and phase 2.

The rules might differ between the two. For example:

- In Step 1, you might be allowed to trade more freely to hit the target.

- In Step 2, you may need to prove consistency – no big profit spikes, tighter risk.

This isn’t a trick. It’s a filter. Firms want to fund traders who not only know how to win, but also how to win with control.

Ask yourself: Can I win with rules, not despite them?

30. Understanding the “No Overnight Holding” Rule

This one trips up a lot of new traders.

Many prop firms don’t allow you to hold futures positions overnight. Sounds limiting? Maybe. But it’s for good reason.

Futures markets often gap overnight, especially between sessions or around global news. A small position can explode into a huge loss in a matter of seconds while you sleep.

“No overnight holding” protects you from that. And more importantly, it protects the firm. Because remember: they’re giving you capital. They expect you to use it wisely – not gamble it on overnight hopes.

31. Trading Hours Restrictions and News Events

Most prop firms will specify exact trading hours, especially for the most volatile instruments. You may see something like:

- No trading before 9:00 AM EST

- No new trades after 4:15 PM EST

- Flat during major news events

These rules exist to help you avoid the most unpredictable periods. That huge NFP candle? Tempting but deadly.

Yes, big moves can mean big gains. But they also mean big slippage, low fills, and extreme spreads. Is it worth risking your funded account on a news spike?

Sometimes, the best trade is no trade.

32. Rule on Economic Releases and News Trading

Let’s talk about one of the riskiest zones in trading: economic news releases.

Some firms require you to be flat before high-impact news like Non-Farm Payrolls, CPI, FOMC announcements, or ECB speeches. Others allow trading but demand a wider stop or lower size.

News can create massive, whipsawing price moves, especially in futures. And if you’re overleveraged, a 20-point spike in ES could end your journey.

So how should you approach it?

Simple: Be aware of the calendar. Plan ahead. Trade around the volatility, not inside it. And always ask: Am I trading the setup or the adrenaline?

33. The Importance of Stop Losses in Prop Trading Rules

You might be thinking, “Do I really need a stop loss on every trade?”

The short answer? Yes. The long answer? Absolutely yes.

In futures prop trading, stop losses aren’t just good practice – they’re often a mandatory rule. Most firms won’t tolerate traders who leave positions open without protection. Why? Because in futures, things move fast. And when they go wrong, they go really wrong.

Without a stop? You could lose multiple evaluation accounts in seconds.

So here’s the better question: Why wouldn’t you want to use a stop loss?

It’s not about fear. It’s about respecting the risk.

34. Daily Goal Targets and Limitations

Now, here’s a rule that surprises many: some prop firms actually limit your daily profit goals.

“Wait, you mean I can’t make more money if I have a great day?”

Correct – at least not without risk management catching up.

Many firms encourage you to stop trading once you’ve met a certain profit for the day. It’s called the “Daily Goal Rule” or sometimes the “Max Daily Gain Advisory.”

Why would they do that? Because most traders lose money after they hit their targets. They keep trading. They get greedy. They give it all back.

So the rule isn’t there to hold you back. It’s there to protect your winning days.

Ever walked away from a green day and thought, “I should’ve kept going”? Try flipping that: how good would it feel to walk away while you’re ahead, knowing your capital and your confidence are still intact?

35. Risk Per Trade: How Much Is Too Much?

Let’s talk numbers. Most prop firms recommend risking no more than 1% – 2% of your total capital per trade. Some even enforce a strict 0.5%.

Sound small? It’s not. Let’s break it down.

If you’re on a $100K account, 1% is $1,000. That’s plenty of room in ES or 6E futures – especially with proper stop-loss placement.

Why does this matter?

Position sizing is the silent killer of prop accounts. Most blow-ups don’t happen because of bad analysis – they happen because of overexposure.

So next time you’re tempted to double up on a trade because it “feels right,” pause and ask: Am I managing risk or chasing hope?

36. Weekly Limits and Rules on Loss Streaks

You’re not a robot. Losses happen. Bad weeks happen. But if you stack too many red days together, you risk spiraling, and that’s exactly what most firms want to help you avoid.

Some firms enforce weekly loss limits or consecutive loss day rules. For example:

- No more than 3 red days in a week

- No trading after 2 losing days in a row

- Take a mandatory break after a 5% drawdown

These aren’t punishments. They’re safeguards.

Ever noticed how your judgment changes when you’re frustrated? You start ignoring your rules. Taking revenge trades. Overtrading.

That’s when a friendly rule reminding you to “step back and breathe” can save not just your account but your long-term mindset.

37. Prohibited Trading Strategies in Futures Prop Firms

Here’s something many traders don’t realize: not every strategy is allowed in prop trading.

Most firms explicitly ban things like:

- Grid trading

- Martingale strategies

- Copy trading (mirror trades across different accounts)

- Latency arbitrage / HFT bots

- Abusive order flow tactics (like spoofing)

Why the restrictions?

These strategies often rely on loopholes or exploit firm risk models instead of using sound, repeatable logic.

And let’s be honest: would you want to build your career on a gimmick or on a skill you can rely on for years?

38. Copy Trading, Grid Trading, and High-Frequency Restrictions

Let’s unpack a few of these.

Copy trading might seem smart. Why not duplicate trades across two different accounts? But in the prop world, that’s often seen as gaming the system.

Grid strategies, where you add more positions as price moves against you, can blow up fast in leveraged markets. Firms hate this because a sharp move can wipe out a “safe-looking” strategy.

And high-frequency bots? These can stress test servers and create unfair advantages. Unless you’re trading with institutional-grade infrastructure, they’re likely to be banned.

Bottom line? Keep it simple. Keep it manual. Keep it honest.

39. Holding into Weekends or Holidays

Weekend holds in futures trading? A big no-no in most prop firms.

Why? Because markets can open with major gaps after the weekend, especially if big global events happen while the exchanges are closed.

Let’s say you hold ES long on Friday, expecting a bounce. Then Sunday night, news breaks out of Europe, and the market opens down 30 points.

Guess what? You didn’t just lose a trade; you possibly violated your drawdown, max loss, and overnight hold rule.

That’s why most firms require you to flatten all positions by Friday close, and sometimes even avoid trading on holiday-thinned liquidity days.

Because again, it’s not just about making profits. It’s about protecting capital.

40. Soft Breaches vs Hard Breaches Explained

Prop firms often divide rule violations into two types: soft breaches and hard breaches.

- Soft breach: You break a minor rule, like holding too many contracts for a few minutes. Usually, you’ll get a warning or have your P&L frozen.

- Hard breach: You break a core rule – max loss, overnight hold, etc. Your account is often terminated immediately.

Think of it like traffic laws. A soft breach is like parking too close to a fire hydrant. A hard breach is like running a red light at 100 mph.

The key? Learn the difference and trade like you want to keep your license.

41. What Happens If You Violate a Rule?

It depends on the firm, but usually, one of three things happens:

- You get a warning. Minor slip-ups may be forgiven, especially during evaluations.

- Your account is paused. You might need to talk to support, review your trades, or wait for the next billing cycle.

- Your account is closed. This happens when you breach hard rules like max loss, or holding overnight.

Is it frustrating? Sure. But it’s also part of the process. The traders who survive are the ones who treat every rule as a non-negotiable boundary, not a suggestion.

42. How to Appeal Rule Violations in Prop Firms

So what happens if you break a rule… but you genuinely think it was a mistake?

Most reputable prop firms have an appeals process. You can reach out to support, explain your case, and ask for a review. Maybe the news hit faster than you could close. Maybe your stop didn’t trigger.

It happens.

But here’s the golden rule: appeal respectfully and take responsibility. Firms are far more likely to reset or reinstate your account if you show professionalism and humility.

Have you ever been on the receiving end of blame and excuses? Doesn’t feel great, does it?

So flip it. Approach support with the mindset of: “I take ownership, and I’d appreciate another shot.” Often, that’s all it takes.

43. How Futures Prop Firms Enforce Rules Technologically

In the old days, compliance teams would manually review trades. Today? It’s all automated.

Most futures prop firms use smart dashboards and real-time trade monitors that automatically:

- Track your drawdown and balance

- Flag overnight positions

- Prevent overleveraging

- Lock your account if risk rules are breached

It’s not Big Brother, it’s smart business. These systems aren’t watching to catch you. They’re built to protect you from yourself.

Think of them as a co-pilot. You’re flying the plane, but they’ll make sure you don’t stall at 30,000 feet.

44. Role of Trade Review and Auditing Tools

Want to get better, faster?

Start reviewing your trades like a coach watches game footage.

Many prop firms now offer integrated trade journaling and analytics tools – some even link directly to your account. You’ll see:

- Entry/exit timestamps

- Lot sizes and risk per trade

- Win/loss streaks

- Average holding times

- Profit per instrument

Why does this matter?

Because you don’t grow by guessing. You grow by observing, adjusting, and evolving. If you can’t explain your last five trades, what went right, what went wrong, then how do you expect to improve?

Trading is performance art. Review is your rehearsal.

45. Building a Rule-Based Trading System

Ever feel like you’re winging it? Like some days you’re on fire, and others, you’re lost in the fog?

That’s the difference between trading emotionally and trading with a rule-based system.

A good system includes:

- Entry criteria (based on market structure, volume, or indicators)

- Predefined stop loss and take profit levels

- A clear risk-per-trade rule

- Session-specific strategies (e.g., trade open range on ES, fade spikes on 6E)

- A filter for avoiding news or choppy conditions

And here’s the kicker: your system should fit the firm’s rules.

Because if your strategy works… but breaks the firm’s rules… then it’s not going to work for you in prop trading.

Want to pass? Build a system that doesn’t just win, but wins within boundaries.

46. How Top Traders Respect and Adapt to Rules

Ever wonder what separates funded traders from those who keep failing?

It’s not luck. It’s not a secret setup. It’s discipline within the rules.

Top traders don’t fight the firm’s system. They embrace it. They adapt their strategies to fit the drawdowns, the contract caps, and the news filters.

They don’t chase profits. They protect their capital. And they treat every trade like it matters, because it does.

Isn’t that what professionals do in every field? Work within constraints, not around them?

In trading, maturity isn’t about how many screens you use. It’s about how well you follow a plan.

47. Customizing Strategies to Fit Firm Rules

Maybe you’re a breakout trader. Maybe you fade highs. Maybe you scan the news. Whatever your style, you can tailor it to match the firm’s rulebook.

Here’s how:

- Reduce your risk size so you stay under drawdown

- Time your entries outside news windows

- Avoid trading too close to the session close

- Use alerts to flatten trades before overnight deadlines

In other words, your strategy is the vehicle. But the firm’s rules? That’s the road.

Drive smart, and you’ll go far.

48. Benefits of Strict Futures Trading Rules

Let’s flip the script. Instead of seeing trading rules as limitations… what if they’re actually your greatest asset?

- Rules force discipline

- Rules prevent emotional spirals

- Rules guide risk control

- Rules create consistency

- Rules build the habits of a professional

Every great trader eventually builds rules for themselves. Prop firms just give you a head start.

So instead of resenting them, ask yourself: What kind of trader would I be without these rules?

Chances are, not a funded one.

49. Common Mistakes New Futures Prop Traders Make

Let’s shine a light on the landmines – so you don’t step on them.

- Trading too big, too soon

- Ignoring max loss rules out of ego

- Chasing the profit target in 2 trades

- Trading around news with no plan

- Overtrading after a red day

- Not journaling or reviewing trades

- Forgetting to check the economic calendar

Sound familiar? You’re not alone.

We all start with emotion. But the ones who evolve? They trade with structure, purpose, and patience.

50. Final Tips for Thriving Under Futures Prop Trading Rules

Let’s wrap this up with a few final gems:

- Master one instrument before trading many

- Treat your evaluation like a real account

- Celebrate green days – even small ones

- Take scheduled breaks to reset your mind

- Never risk more than you’re willing to lose – emotionally

- Be kind to yourself. Every trader stumbles. Just don’t stay down.

At the end of the day, prop trading isn’t a game of genius – it’s a game of resilience. Stay in the game, learn from every trade, and build momentum brick by brick.

You’ve got what it takes. Now go prove it.

51. Conclusion: Why Rules Make or Break Your Prop Trading Journey

Futures prop trading is more than a shortcut to capital; it’s a test of who you are under pressure.

Every rule you face, every limit on drawdown, max loss, or timing, isn’t a wall. It’s a mirror. It reflects your habits, your discipline, and your readiness.

So ask yourself: Are you trading to impress others? Or are you trading to become the kind of trader who earns trust, capital, and long-term success?

Because in this game, it’s not the boldest who win. It’s the ones who can follow rules with precision and adapt when needed.

And if you can do that? There’s no limit to what you can build.

FAQs on Futures Trading Rules

1. Why are futures day trading rules so strict?

Because futures markets are highly volatile, strict rules help avoid large, unexpected losses.

2. What is a daily drawdown limit?

It’s the maximum amount you’re allowed to lose in a single trading day before breaching the account.

3. How does max loss differ from drawdown?

Max loss is the total allowable loss on the account, while drawdown refers to losses from the peak balance.

4. Are overnight trades allowed in prop firms?

Most firms prohibit holding futures positions overnight due to the risk of price gaps.

5. What are the trading rules for the ES futures?

Firms often set tighter position size limits, stop-loss requirements, and news trading restrictions for ES futures.

6. What happens if you violate a futures trading rule?

Violations can result in account suspension, disqualification, or reduced capital allocation.

7. How can I adapt my strategy to firm rules?

Reduce position sizes, avoid trading during news, and always use stop losses to align your system with firm guidelines.

Disclaimer: All information provided on this site is for educational purposes only, related to trading in financial markets. It is not intended as financial advice, business or investment recommendation, or as an opportunity or recommendation to trade any investment instruments. Hola Prime only provides an educational environment to traders, including tools, materials and simulated trading platforms which have data feed provided by Liquidity Providers. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations.